Thanks to Fluidreview for the infographic. Check out the original here.

Category Archives: Cost of education

The State of the Union — brought to you by our sponsors…

Education was big in Obama’s annual State of the Union address. In fact, he opened the speech by praising the work of teachers and boasting about the graduation rate, now at its highest level in decades. He then went on to discuss several education-related issues, ranging from pre-K to student debt to skills training to broadband access.

None of it was new really, but the good thing about having a congress that doesn’t pass anything is that you don’t need so many new ideas, just push a little harder on the old ones. For supporters of those ideas, Obama’s continued commitment comes as good news, even if it’s not new news.

For me, two statements in particular stood out. First, Obama repeated a 2013 pledge to connect 99% of students to broadband internet in the next four years. As an education internet start-up, we obviously liked that news. To accomplish that, the administration plans to work with the FCC and companies like Apple, Microsoft, Sprint, and Verizon, he said.

Second, Obama mentioned plans for the US Treasury and Education Departments to team up with accounting software company Intuit to better educate students and recent grads on how loan repayments work and what options they have. We’ve written quite a bit about student debt in this blog and are all about young adults getting some help on that front.

I was happy to hear about both of these proposals, but that’s not why they stood out to me. I found them interesting because, in both cases, Obama navigated around Congress by seeking out support from the private sector. In 2013, Congress had its least productive year in recent history. With that in mind, it seems reasonable for Obama to explore other options.

Still, the approach warrants some scrutiny. As appealing as these two ideas are, I do wonder if we are opening up another avenue for corporate sponsorship. If so, does it matter? What would a presidential shout-out in an advertisement-free, State of the Union address be worth?

I don’t mean to be overly critical. I think it’s cool that these companies are helping out and that the administration can move forward on this without adding anything to the deficit and without struggling through Congress. The relationships between corporations and governments are made of powerful stuff, though, and we should be conscious of that power, even when it’s contributing to worthy causes.

Free your mind – The push for cheaper textbooks

As anyone who reads this blog knows, the cost of education is an important topic for us. One of our goals is to expand the number of education options for everyone in the entire world. Lots of people are trying to do similar things, especially those in the movement to have more open source educational material.

Those folks are getting some support from two US senators. Senator Dick Durbin of Illinois and Senator Al Franken of Minnesota have proposed a bill to offer public funding for the creation of education textbooks on the condition that the material then be offered free of charge.

Here’s what Senator Franken said about the bill. “I’m proud to introduce this bill because it will help provide cheaper alternatives to traditional textbooks and keep more money in students’ pockets, where it belongs.” Here is what Al Franken said when he used to be an actor on Saturday Night Live. I bet he’s proud of that, too.

Textbook costs are more significant than one might think. The average student at a four year public university spends about $1200 per year on textbooks, according to the College Board. Since 1978, the cost of textbooks has risen 812%, according to this analysis from Mark Perry of the American Enterprise Institute. That is higher than the growth rate for healthcare, real estate, and general consumer prices.

The high costs translate into big business for education publishers as well as textbook renters and re-sellers. They are reluctant to cede that market to the open source movement. That does not mean they are not preparing. The three largest publishers, London-based Pearson, New York-based McGraw-Hill, and Boston-based HoughtonMifflin Harcourt, are all working on digital content strategies. Check out more about that in this great article by Michelle Davis at Education Week.

In terms of the Senate bill to fund textbook creation, I can see a potential problem. I am no hardcore capitalist or anything, but if the funding comes without regard to how often the textbooks are used, then the authors lose some incentive for making engaging, high quality content. They don’t need to be as competitive. That may or may not be a problem. Time will tell.

On the positive side, the increasing use of electronic formats for e-readers and laptops could reduce textbook costs further and expand the reach of free educational content. The benefits could easily overflow the borders of the US, helping students around the world.

At Rukuku, we’ve done our best to make content creation as painless as possible. Our Composer feature allows teachers to simply cut and paste text, graphics, and video into class worksheets.

The trend, regardless of whether this bill passes or not, is toward open resources. Composer can help teachers organize those free resources into class materials. Those materials can then be shared, or possibly even sold, on Rukuku’s Marketplace.

Rock Enroll: Fewer people enroll in post-secondary education

College costs are going up. Everybody’s talking about it, including us. The tricky thing is, if prices are going up, and enrollments are going up, then shouldn’t that be a sign that college is not overpriced. I mean, people are still willing to pay for it. Just simple economics, right?

It is actually not simple economics, as there are all sorts of arguments on the societal benefits of having a well-educated population as well as arguments that education is not your typical consumer good. I’m not going to get into those in this particular post.

Instead, I am going to highlight an interesting stat released by the US Census Bureau a few weeks back. After more than a decade of rapid growth, college enrollments are going down. In 2012, the total number of students enrolled in college fell by half a million from the year before, according to their figures.

Why did that happen? I don’t know but that’s not going to stop me from pointing out some possibilities. The most obvious of those is price. As we’ve pointed out before, educational costs grew by 165% from 1993 to 2011, faster than general inflation and medical costs. The pace of increase is slowing, luckily, with prices at public four year universities up only 2.9% in 2012, according to the College Boards.

On the other side of that same coin is the job market. Job prospects are dim and have been for many years. A college degree will make that job search easier, but high school kids are likely shaken by the uncertainty, especially when looking at college price tags and average debt loads.

The prospect of being young and jobless is scary. The prospect of being young and jobless and tens of thousands of dollars in debt is terrifying. The average graduating senior this year was in seventh grade when the economy tanked. That’s a lot of years to let the idea of a crappy job market sink in.

Students over 25 are even more sensitive. In that that group of older students, 419,000 fewer people enrolled in post-secondary education in 2012 than in the year before, accounting for almost 90% of the total decrease in enrollment.

Luckily the continuing conversation over college costs has brought more awareness to the issue. Already, rankings on affordability are becoming more prominent, and colleges are marketing their financial value to prospective students as well as their academic rigor.

Meanwhile, companies like Rukuku are utilizing technology to bring more affordable options to students. This will put even more pressure on the colleges to justify their prices tags.

Financial Aid and the Plight of the Financially-Challenged

I am a huge fan of need-based aid, as I described in this post last week. That doesn’t mean there aren’t some problems with the system. At the end of the day, most universities still prefer students that can pay their part. To do this, while maintaining the need-blind admission label, universities have employed a few techniques.

One of these ways is early admission. Early admission policies allow students to apply in the fall to their favorite schools, and in return, those students must commit earlier to attend these schools. That seems harmless enough on the surface. In fact, a senior year of high school where one already has college plans sorted sounds like a lot of fun.

The problem is, information on financial aid packages is still not available until the spring. If the amount of financial aid offered could influence your decision (aka, paying full price is not an option for you), then you may not be able to commit early. This is one way that colleges can ensure they are getting students that can contribute more in tuition.

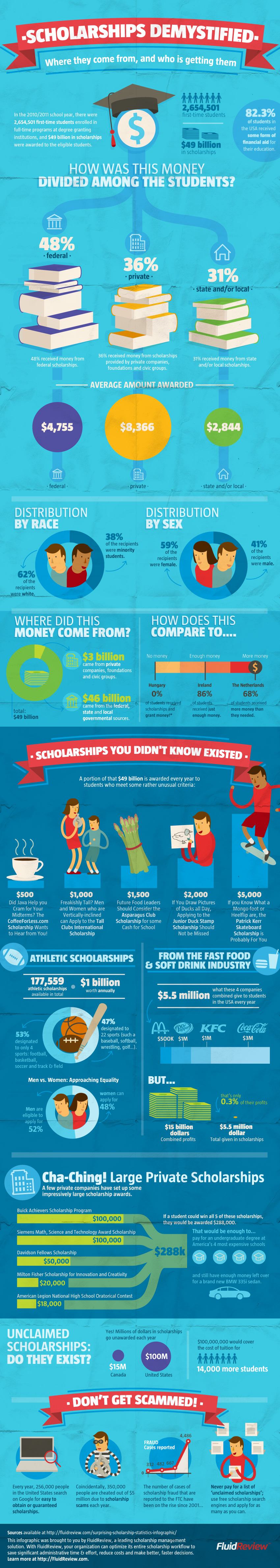

A second way is by offering merit-based scholarships rather than need-based scholarships. How could offering more scholarships be bad for poorer students? Seems crazy, right? This is how it could work. A $5000 merit-based scholarship for a student that can pay the remaining $20000 is far better for the school than offering a $20,000 need-based scholarship for a student that can only pay $5000. With that $20,000 need-based scholarship, the school can offer four $5000 merit scholarships, bringing in $80,000 in tuition.

This is especially helpful for state-owned schools, where out-of-state students pay a much higher price. Giving them a merit-based scholarship may convince them to attend, when they will actually still pay much more than the average student. According to a May study by the New America Foundation, the percentage of students at private universities that received merit-based aid increased from 24% to 44% from 1995-97 to 2006-07, while the percentage receiving need-based scholarships decreased from 43% to 42%.

Along similar lines, the increase in student loan limits seems at first like a measure that should help low-income students. In reality, however, the increase in student loan limits has come with rising tuitions. There are many reasons for those rising costs, as we’ve discussed in past posts, but the net result is that low-income students graduate with much more debt than in the past. Students graduated with an average annual debt load of $35,200 this year, according to research from Fidelity Investments.

So what’s happened as a result of all this? Unsurprisingly, high-performing students from lower income backgrounds are less likely to attend prestigious schools. This has some serious consequences for those students. Similarly performing students that attend more selective universities have better chances of graduating and higher lifelong earnings.

According to research from the Georgetown Public Policy Institute, students with SAT scores of 1100-1199 that attended one of the 468 most selective schools had an 81% graduation rate, while those that attended open access two and four year schools had graduation rates of only 53%. Ten years after finishing schools, the graduates from the selective programs made $67,000 a year, on average, compared to $49,000 for those attending less selective schools.

The new ranking system that the Education Department is working on may address some of these issues. It will be tough to reach the proper balance in that ranking, as we’ve highlighted before, but it is a project worth pursuing.

For the record, the New America Report highlighted the fifteen schools below for being particularly generous in offering need-based aid, so for any of you out there looking at colleges, keep these guys in mind: Amherst College, Vassar College, Grinnell College, Williams College, MIT, Wellesley College, Cooper Union, Stanford University, University of Richmond, Pomona College, Rice University, Cornell University, Bowdoin College, Wesleyan University, and Dartmouth College.

Marketing 101: How do Academic Interests Translate into Bullet Points and Discussion Topics?

Last week, we discussed some of the ways in which universities are trying to make liberal arts courses more marketable through activities like group work and class presentations. Another part of that process, though, is presenting what one has learned in a positive light to potential employers. To do that, students, recent grads, and job seekers in general need to turn their interests and experiences into resume bullet points and interview discussion topics.

Students turn interests into resume bullet points and interview talking points to build their own brand.

Are you taking a class on the Roman Empire? Cool, explain how the class helped you better understand the downfall of Lehman Bros. Class on Shakespearean literature? Discuss Macbeth’s leadership strengths and flaws. Are you in a punk rock band? Awesome, put a bullet point on the CV and talk about how you overcame adversity to book gigs and manage the band budget, all while keeping the drummer sober.

It’s kind of fun to make those connections. Demonstrates creativity. (Quick write that down for your next interview.) I do wonder, though, how that pressure to make everything marketable influences the educational experience. We think of higher education, or at least I think of higher education, as a time when students are encouraged to challenge assumptions and continually ask why. Do we sacrifice any intellectual space by following our ‘why’ questions so quickly with ‘how does that relate to a career”?

I don’t have an answer for that and am very interested to hear if any educators, students, or other readers have opinions to share. How strongly should the potential marketability of a class or an activity factor into a student’s choice to participate? Do those considerations make classes any less academic?