I admire Udemy for their unique approach to managing growth, and I regularly collect and analyze all and any data about them that I can get. The company is a peculiar business case in the growing edtech world because:

- They are one of the fastest growing virtual training companies in the world

- Their business model works

- They can be profitable

My recent annual analysis of Udemy data has yielded interesting results. In short, Udemy is deliberately diversifying its content portfolio and breaking dependencies on particular course providers.

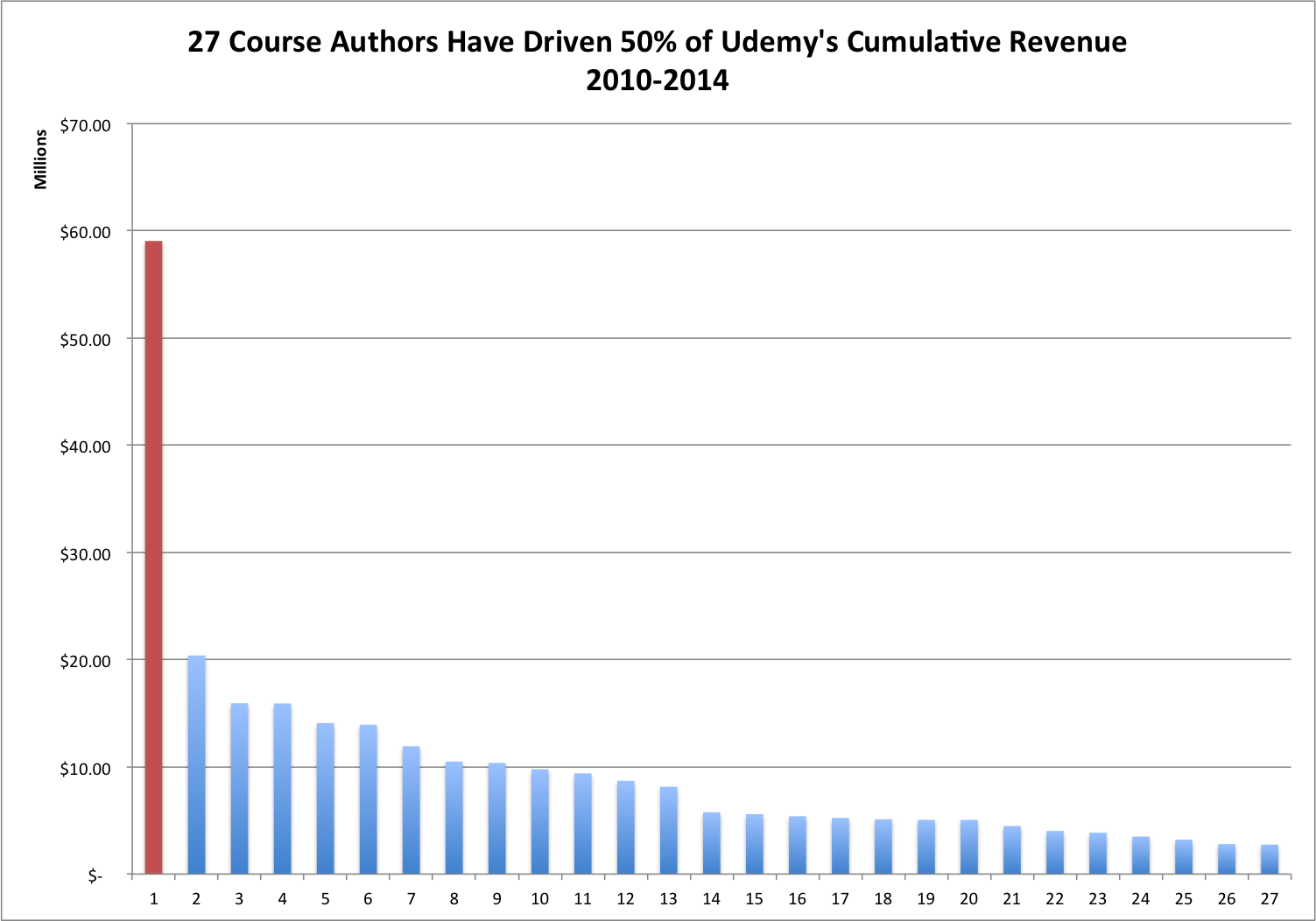

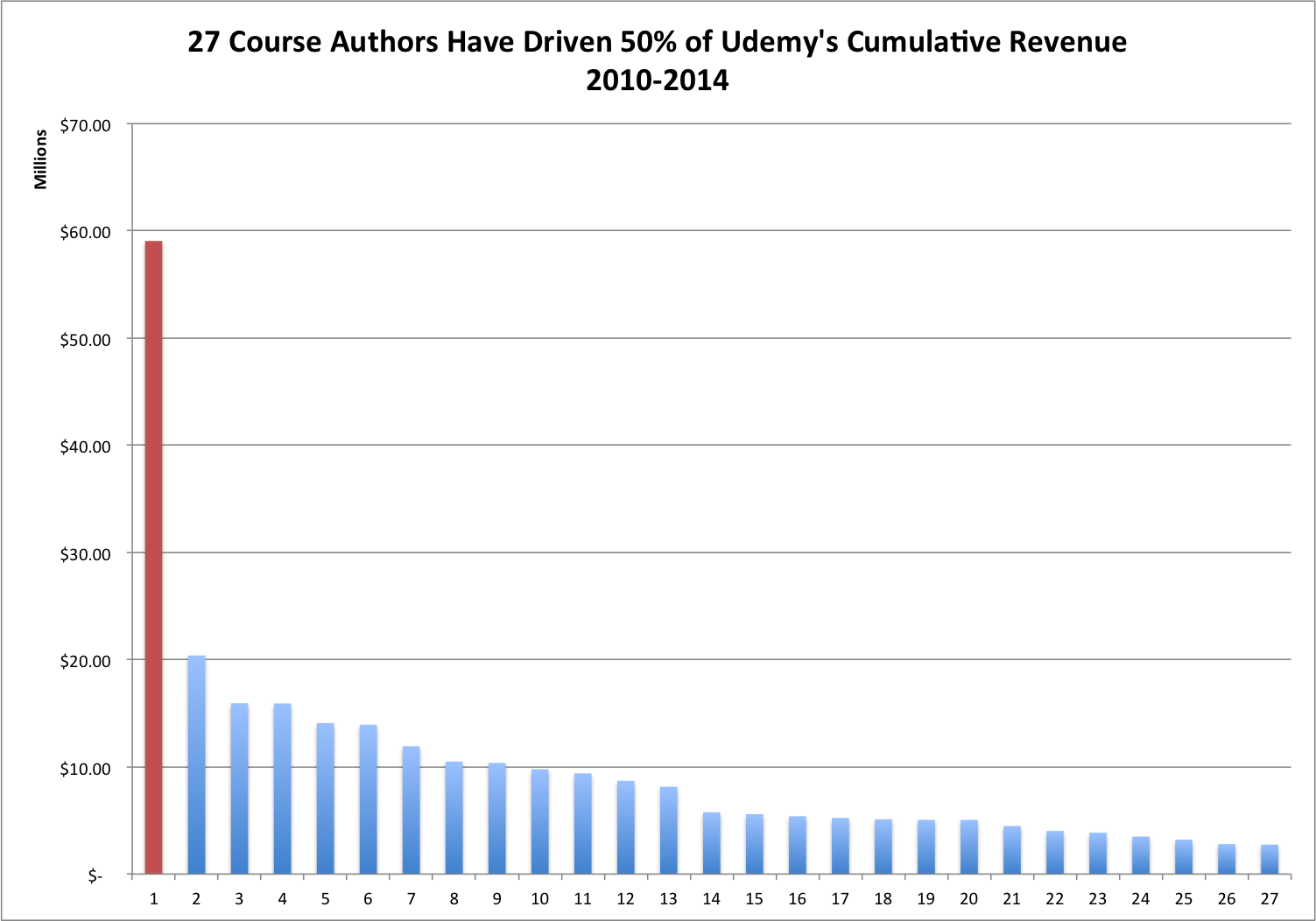

1. Udemy is no longer overly dependent on just one course provider. In January 2014 close to 50% of their cumulative revenues came from a single company in Canada: Infinite Skills. Our November 2014 data shows that Udemy saw that risk very clearly, and worked hard to diversify its course portfolio. This effort seems to have born fruit: 50% of the company’s cumulative revenues now comes from 27 providers. As this diversification took place in the past twelve months, it seems that Udemy’s content managers and the marketing team are making a deliberate effort to break away from dependence on Infinite Skills.

In November 2014, 27 course providers were responsible for 50% of Udemy’s revenues.

2. Udemy is no longer an Excel training company it used to be twelve months ago. Back in January this year, seven out of ten top courses by enrollment and revenue on Udemy were about Excel. Although Microsoft Excel courses are still VERY important in Udemy’s portfolio, the company has made a successful shift into Software development and Business categories. The new course providers that Udemy has managed to bring in generate quite a bit of revenue in areas of marketing and mobile app development.

Software development and business dominate Udemy’s portfolio in terms of revenue.

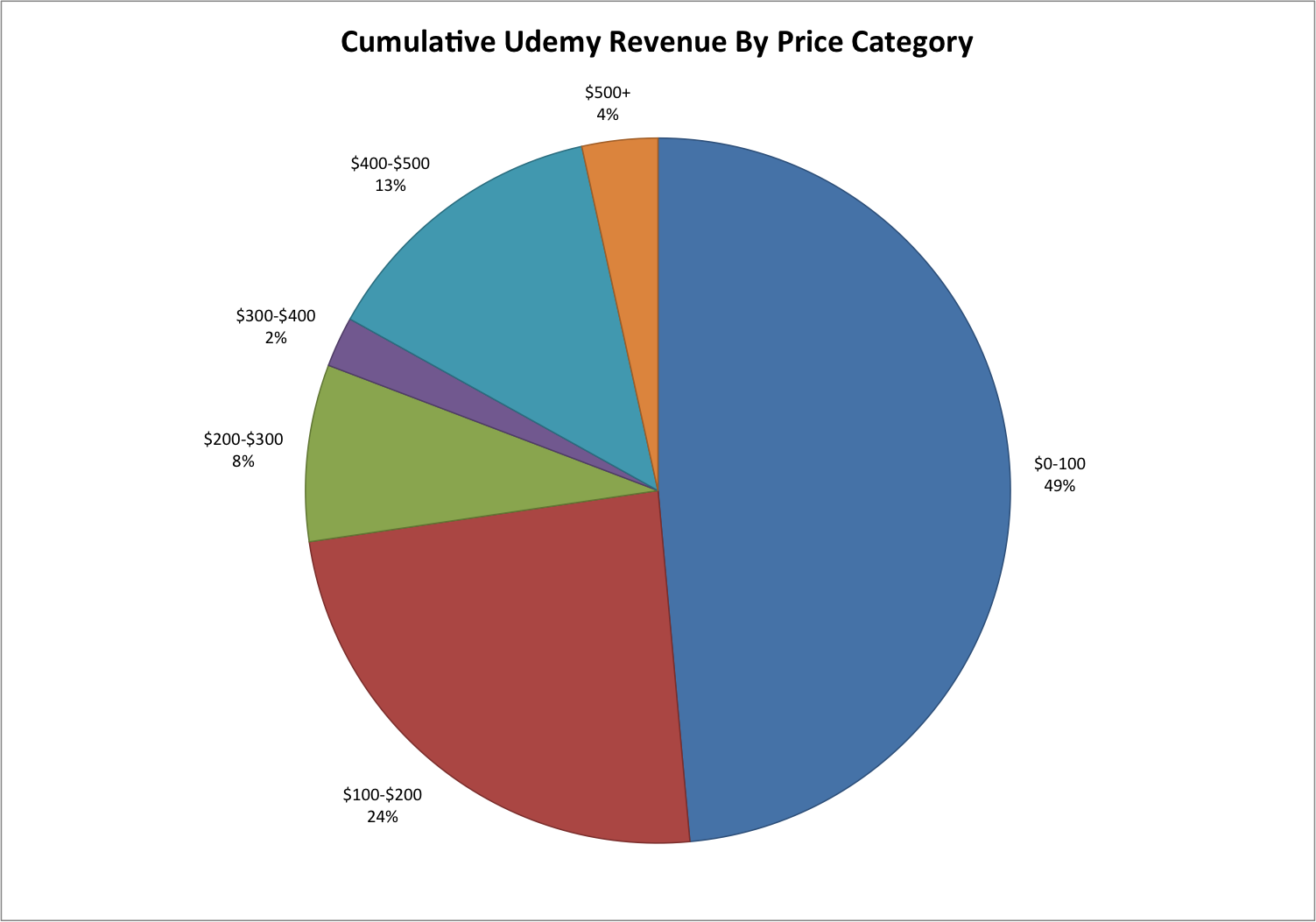

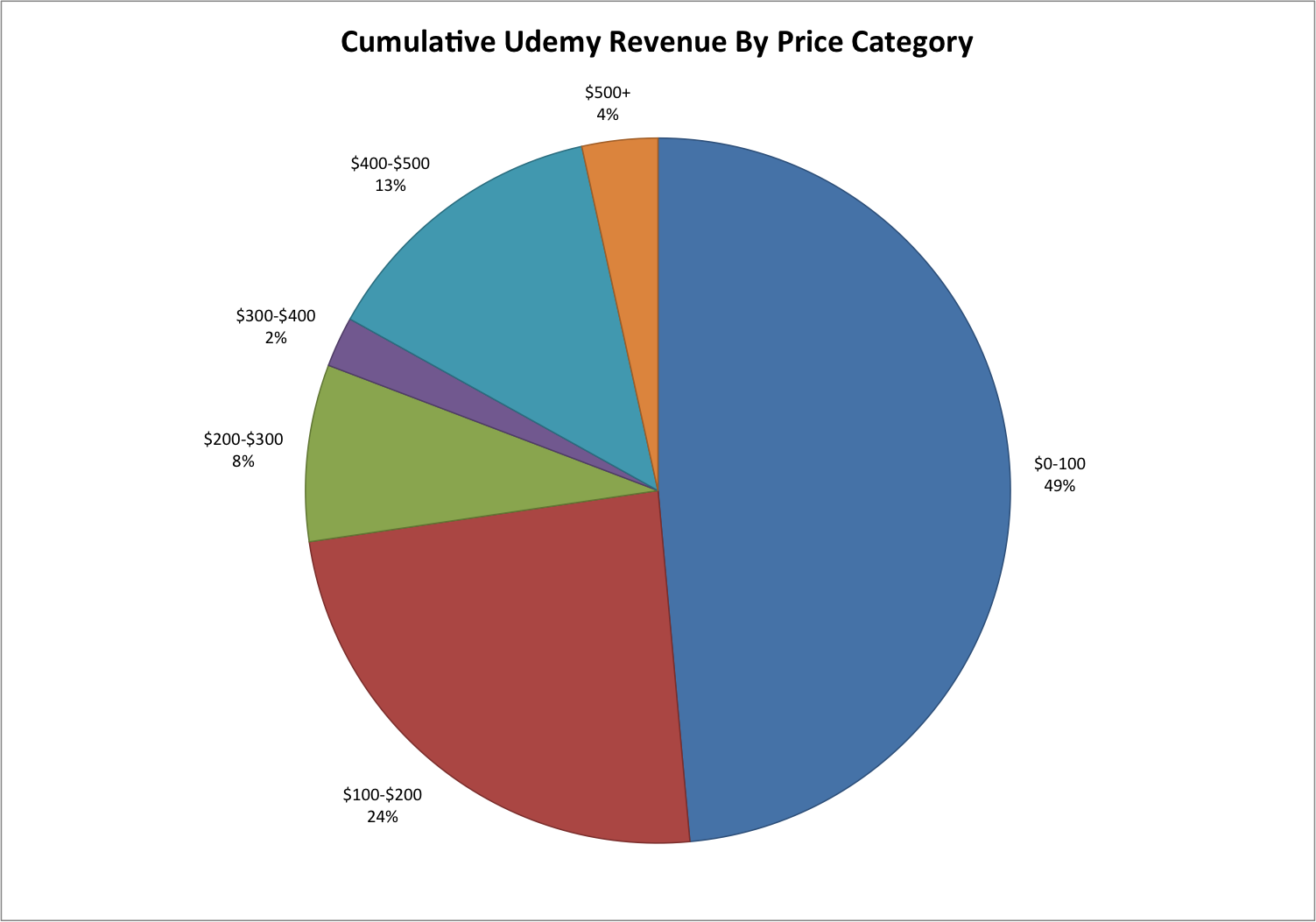

3. 10% of enrollments drive 50% of cumulative revenues. Udemy remains in a tough spot in terms of pricing and market positioning, although this seems to be changing, albeit slowly. In the online education and training world, I place Udemy in “basic office skills and basic technology skills” content category where brand of course provider does not matter as much as the quality of content they produce. Based on our data, in 90% of cases Udemy’s value proposition is “commoditized knowledge at bargain prices”. 50% of cumulative revenue to date comes from 90% of all enrollments within the “$1-$100” price range. What’s amazing is that the other half of revenues to date has come from just 10% of all paid course enrollments that come from all other price segments ranging from $101 to $5000 per enrollment. Obviously, this is a completely different market segment and it is a least just as important for Udemy as its most popular price segment.

Udemy’s difficulty next year would be in managing its polarized user base.

If you need access to our database, please sign up to my live seminar: I will be doing a live review of Udemy data on January 15, 2015 at 12:00PM PST on Rukuku. During the event, I will present my findings and analysis of online trainig trends that can be glimplsed from comparing 2013 and 2014 data.

When you sign up, you will have access to the full raw database that contains most up-to-date information on Udemy’s courses, user and revenue growth, pricing strategies, etc. After the live event, you will also have access to Udemy January 2013 data as well as my analysis of changes that took place.

Join Rukuku and build your business around your teaching